Medicare

Medicare is easier

with Find Rx Coverage

We’ll help you find a plan that fits your

needs.

Online

opens a simulated dialogGet free advice & compare plans with a licensed insurance agent*

Phone

We’re taking you to eHealth

You’re leaving Walgreens to compare plans and explore options with licensed agents on eHealth.com. Any information you provide will be subject to the eHealth privacy and security policies.

UnitedHealthcare plan options

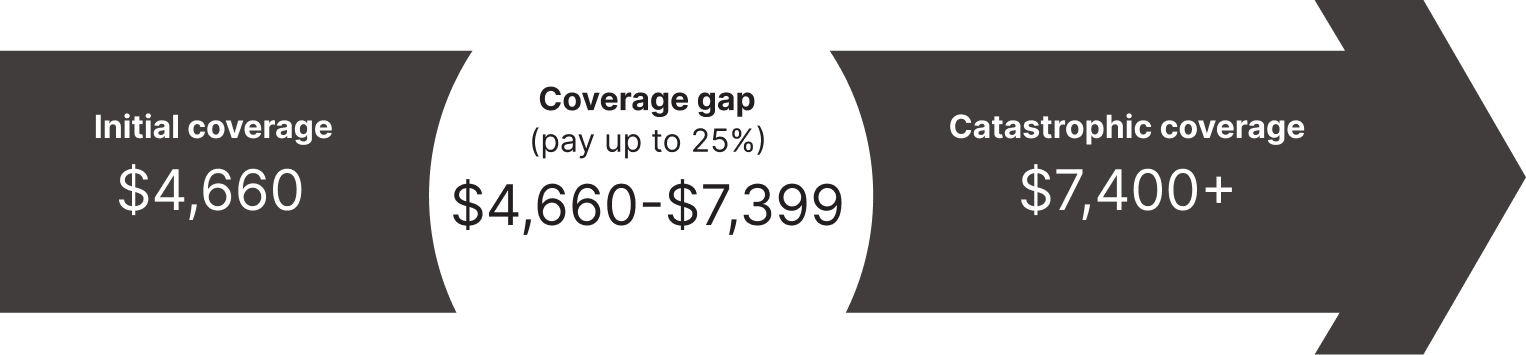

near Find Coverage Gap coverage using zipcode. opens in a simulated dialogMost Medicare Part D prescription drug plans have a coverage gap that limits what the plan will cover after you've reached your initial coverage limit.

The 2024 standard initial coverage limit is $4,660.§ Once you and your plan spend more than $4,660 on covered prescription drugs, you'll pay up to 25% of the cost for brand name and generic prescription drugs covered by your plan until your out-of-pocket costs reach $7,400.**

UnitedHealthcare plan options

What do you need to do?

In the coverage gap: You'll pay up to 25% for the cost of each medication and out-of-pocket prescription drug costs from the time you meet your deductible until you reach catastrophic coverage. If you have a Medicare Part D prescription drug plan that includes coverage in the gap, you may get a discount after your plan's coverage has been applied to the prescription drug price. The discount for brand-name prescription drugs will apply to the remaining amount you owe.

Your plan's yearly deductible, coinsurance, or copayments, and what you pay while in the coverage gap, all count toward this out-of-pocket limit. However, your plan's monthly premium does not count toward this limit.

Brand-name vs. generic discounts

For covered brand-name prescription drugs, in 2024 you pay 25%, but the entire price counts as out-of-pocket costs, which helps you get out of the coverage gap. For generic prescription drugs, you'll pay 25% of the cost in 2024. With generic prescription drugs, only the amount you pay counts toward getting you out of the coverage gap.

Here's what counts toward the coverage gap:

- Your yearly deductible, coinsurance and copayments

- The discount you get on brand-name prescription drugs in the coverage gap

- What you pay in the coverage gap

Here's what doesn't count:

- Your Medicare Part D prescription drug plan premium

- The pharmacy dispensing fee

- What you pay for prescription drugs that aren’t covered

What qualifies for these discounts?

You'll receive the discounts once you reach the coverage gap if:

- You are enrolled in a Medicare prescription drug plan or a Medicare Advantage plan that includes prescription drugs.

- You don't receive Extra Help, a Medicare program to help people with limited income.

We are taking you to ehealthinsurance

Any information you provide will be subject to ehealthinsurance privacy and security policies.

You are now leaving Walgreens.com

Any information you provide will be subject to thirdparty site's privacy and security policies.

Got it* No obligation to enroll. This ad is not from the government. It's from eHealth, an insurance agency selling plans from many insurance companies. Enrollment in a plan may be limited to certain times of the year unless you quality for a special election period, or are in your Medicare Initial Period. Deductibles, copay and coinsurance may apply.

† Mon.–Fri. 8 am to 9 pm, Sat. 10 am to 7 pm ET. eHealth is a licensed insurance broker. No commissions are paid to Walgreens.

‡ Advice is free with no obligation to enroll and provided by independent licensed agents representing one or more plans. Licensed agents are not employees or agents of Walgreens, eHealth or any government agency.

** Source: www.medicare.gov/drug-coverage-part-d/costs-for-medicare-drug-coverage/catastrophic-coverage Opens medicare.gov in new tab

https://www.cms.gov/files/document/2023-announcement.pdfOpens cms.gov in new tab